Financial Offshore Structures That Offer Maximum Versatility for Wealth Holders

Financial Offshore Structures That Offer Maximum Versatility for Wealth Holders

Blog Article

Why You Need To Take Into Consideration Financial Offshore Options for Possession Protection

In an era noted by financial fluctuations and growing lawsuits threats, people seeking durable possession security might find relief in offshore economic options (financial offshore). These choices not only supply boosted privacy and possibly reduced tax obligation prices but additionally produce a strategic buffer against residential monetary instability. By discovering diverse financial investment landscapes in politically and financially stable countries, one can attain an extra protected financial ground. This approach triggers a reconsideration of asset management practices, urging a better look at how offshore techniques could offer lasting economic goals.

Recognizing the Basics of Offshore Banking and Spending

While lots of people look for to enhance their financial protection and personal privacy, overseas financial and investing emerge as practical approaches worth considering. Offshore financial refers to managing financial properties in establishments located outside one's home country, commonly in territories known for beneficial governing atmospheres.

These monetary strategies are especially eye-catching for those intending to secure assets from economic instability in their home nation or to get to financial investment items not offered in your area. Offshore accounts may also offer stronger possession security versus lawful judgments, possibly protecting riches better. Nonetheless, it's essential to comprehend that while overseas banking can supply considerable benefits, it additionally includes complicated factors to consider such as comprehending foreign economic systems and navigating currency exchange rate variations.

Lawful Considerations and Compliance in Offshore Financial Activities

Trick conformity issues include adhering to the Foreign Account Tax Compliance Act (FATCA) in the USA, which calls for coverage of foreign financial possessions, and the Typical Reporting Standard (CRS) set by the OECD, which includes info sharing in between countries to battle tax obligation evasion. Furthermore, people should be mindful of anti-money laundering (AML) regulations and know-your-customer (KYC) policies, which are strict in lots of jurisdictions to avoid prohibited tasks.

Comprehending these legal ins and outs is critical for preserving the authenticity and security of offshore economic involvements. Correct legal assistance is necessary to make sure full conformity and to optimize the benefits of offshore economic approaches.

Comparing Residential and Offshore Financial Opportunities

Comprehending the legal complexities of overseas monetary tasks aids capitalists acknowledge the differences in between dig this offshore and residential economic chances. Locally, capitalists are often more accustomed to the regulatory atmosphere, which can offer a complacency and ease of access. United state banks and investment firms operate under reputable lawful structures, providing clear guidelines on taxes and financier security.

Offshore monetary opportunities, nonetheless, generally use better privacy and possibly reduced tax rates, which can be advantageous for property protection and development. Jurisdictions like the Cayman Islands or Luxembourg are preferred due to their favorable monetary policies and discernment. These advantages come with obstacles, including enhanced analysis from global regulative bodies and the complexity of taking care of financial investments across different legal systems.

Financiers should consider these elements carefully. The selection in between residential and overseas alternatives need to straighten with their economic goals, danger resistance, and the lawful landscape of the corresponding jurisdictions.

Steps to Begin Your Offshore Financial Trip

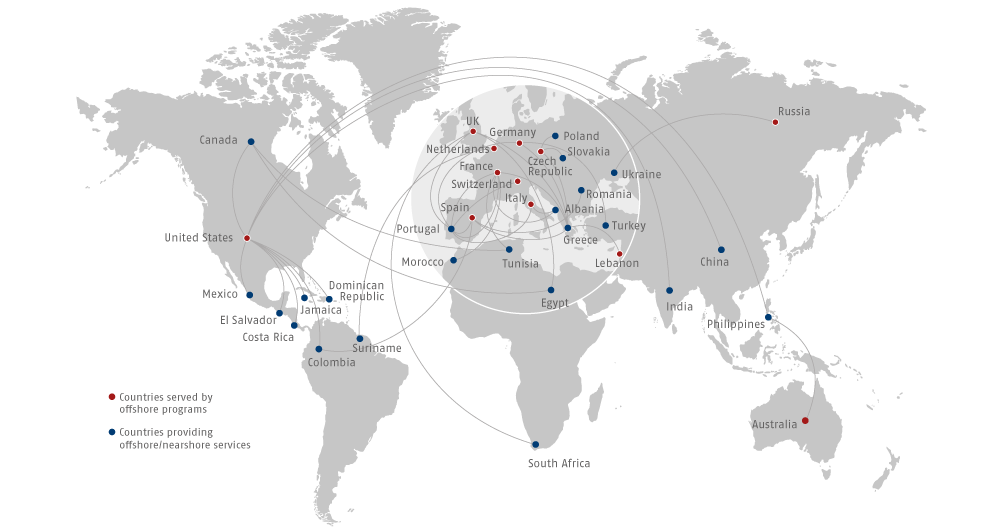

Embarking on an offshore economic journey calls for mindful planning and adherence to legal guidelines. Individuals have to initially conduct comprehensive research to recognize suitable countries that provide durable monetary services and positive lawful frameworks for possession protection. This entails reviewing the political security, economic setting, and the details regulations connected to overseas monetary tasks in potential countries.

The next action is to talk to an economic consultant or legal specialist that specializes in global money and pop over here tax. These professionals can offer tailored guidance, making certain conformity with both home country and global laws, which is critical for staying clear of legal repercussions.

When a suitable jurisdiction is picked, people ought to wage establishing up the essential monetary structures. This generally consists of opening up savings account and creating legal entities like counts on or corporations, relying on the person's specific financial goals and needs. Each action ought to be carefully recorded to maintain openness and facilitate continuous conformity with regulative needs.

Verdict

In a period noted by economic fluctuations and growing lawsuits threats, individuals seeking robust property security may locate solace in overseas monetary options. financial offshore.Involving in offshore economic activities necessitates a comprehensive understanding of lawful structures and regulatory compliance across various territories.Understanding the lawful intricacies of offshore monetary activities assists capitalists recognize the distinctions in between residential and overseas economic possibilities.Offshore financial chances, nevertheless, usually use greater personal privacy and potentially lower tax obligation prices, which can be advantageous for asset protection and development.Beginning on an offshore financial trip requires cautious planning and adherence to legal guidelines

Report this page